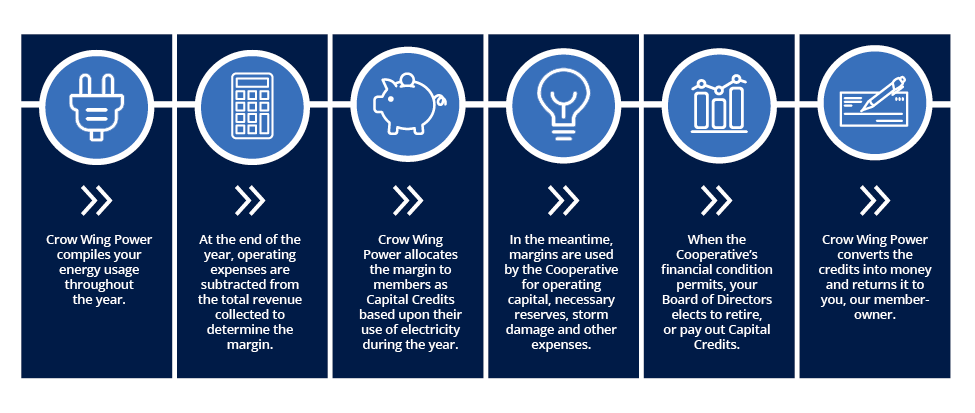

Crow Wing Power is a not-for-profit, member-owned, electric utility. That means you, not a group of private investors, benefit from any margins produced by the Cooperative.

CAPITAL CREDITS

As a not-for-profit cooperative, you are part owner. One advantage of being a member-owner is that margins over and above the cost of current-year operations are returned to members in the form of capital credits. The amount of electricity a member uses determines the amount of credit that a member receives. Between the time capital credits are assigned and the time they are refunded, the money is re-invested into the cooperative in order to maintain, improve, and ensure dependable service. When the Cooperative’s financial position permits and with consideration to rate fairness, Crow Wing Power retires, or pays these capital credits back to its members.

LEARN MORE

For more information about capital credits, check out our FAQs.

In November 2025, Crow Wing Power returned $1,676,228.18 in Capital Credits to 29,885 members. This includes about $1.1 million for members who received electric service in 2010 and over $550,000 from Great River Energy, our wholesale power provider at that time, for service in 1991.

Capital Credits represent margins collected beyond operating costs during those years. These amounts were allocated based on each member’s electric use and are now being returned.

Active members receive a bill credit. Members that are no longer active, receive a mailed check.

Read the 2025 Capital Credit Article

Crow Wing Power serves members with safe, reliable power and a responsive team that takes pride in every connection.

UNCLAIMED CAPITAL CREDITS

Each year, funds that were returned by the Post Office or not claimed are returned to the Cooperative and held in an unclaimed account for seven years. We need your help locating the members that these unclaimed capital credits belong to. Any information you can provide regarding the location of these members is greatly appreciated. Those with information can call our Billing department at (218) 829-2827.

Crow Wing Power does its best to deliver capital credits to former or current members who have moved from their last known address or did not cash a check that was sent to them. It is recommended that you keep your most recent address on file by calling Crow Wing Power. We continue to carry unclaimed capital credits amounts on our books for up to seven years. If, after the required time, we still have not located you, the law requires us to either turn the money over to the state or donate it to a charitable organization. Our current policy, as set by the board of directors, is to donate all unclaimed capital credits money to local community colleges and schools for student scholarships and educational purposes.